Child Tax Credit 2024 Canada Schedule – The proposed deal would increase the maximum refundable amount per child to $1,800 in tax year 2023, $1,900 in tax year 2024, and $2,000 in tax year 2025. Additionally, the maximum $2,000 child tax . Child tax credits are likely to be expanded thanks to a $78 billion tax agreement between the Democrat-led Senate Finance Committee and the Republican-helmed House Ways and Means Committee. .

Child Tax Credit 2024 Canada Schedule

Source : twitter.com

Child Tax Credit Definition: How It Works and How to Claim It

Source : www.investopedia.com

Samantha’s Law on X: “#Alberta Benefit Payment Dates. https://t.co

Source : twitter.com

Building on our work to deliver dental care for kids, our new

Source : www.instagram.com

Employment and Social Development Canada on X: “???? The new

Source : twitter.com

2023 and 2024 Child Tax Credit: Top 7 Requirements TurboTax Tax

Source : turbotax.intuit.com

Liberal Party on X: “More seniors can now register for the Canada

Source : twitter.com

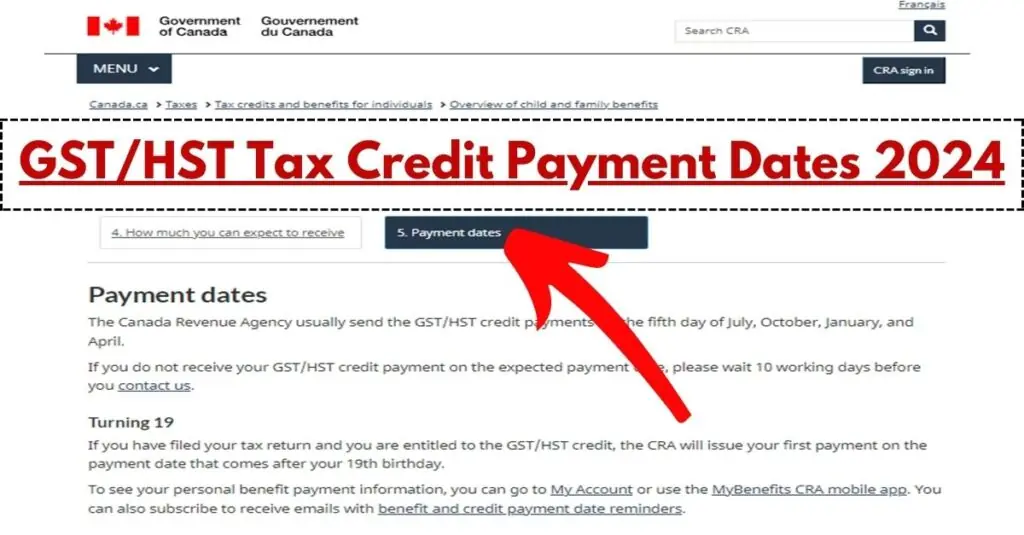

Canada GST/HST Tax Credit Payment Dates 2024: GST/HST credit

Source : bharti-axagi.co.in

Employment and Social Development Canada ???? The new Canadian

Source : m.facebook.com

GST/HST Credit Payment Dates in Canada 2023 2024 | 2022 TurboTax

Source : turbotax.intuit.ca

Child Tax Credit 2024 Canada Schedule Samantha’s Law on X: “#Alberta Benefit Payment Dates. https://t.co : Congressional negotiators announced a roughly $80 billion deal on Tuesday to expand the federal child tax credit that, if it becomes law, would make the program more generous, primarily for low-income . A new tax bill aims to increase access to the child tax credit for lower-earning families — but it’s much less generous than it was in 2021. .

:max_bytes(150000):strip_icc()/child-tax-credit-4199453-1-7dd01914195e4ab2bc05ae78a40f8f0c.jpg)